Published in 23/11/2023 at 18:34:22

On Thursday (Nov 23) Petrobras' Strategic Plan for 2024-2028 (PE 2024-28+) was approved by the company's Board of Directors. Over the next five years, investments of USD 102 billion are expected to be made, an increase of 31% compared to the previous PE. PE 2024-28+, the first plan designed under the new administration, aims to prepare Petrobras for the future and make the company stronger by integrating energy sources that are essential for a fair and responsible energy transition.

“We have increased Petrobras' total investments responsibly, maintaining a focus on capital discipline and a commitment to keeping debt under control. Additionally, we have directed investments towards low carbon projects with a focus on profitability to generate long-term value. The energy transition will unfold gradually and responsibly as we will invest in new energy sources along with our ongoing investments in oil production. This approach is still necessary to meet global energy demands and finance the energy transition”, highlights Petrobras’ President, Jean Paul Prates.

The new plan will focus on people, safety and respect for the environment, thus generating value for future generations. Governance will be upheld in every decision-making process and project evaluation, in an effort to ensure sustainability and profitability, while enhancing transparency.

This plan also has the potential to make a strong contribution to Brazilian society. According to estimates, approximately 60% of Petrobras' cash generation will return to society in the form of taxes and payments to the federal government, states and municipalities.

More investments

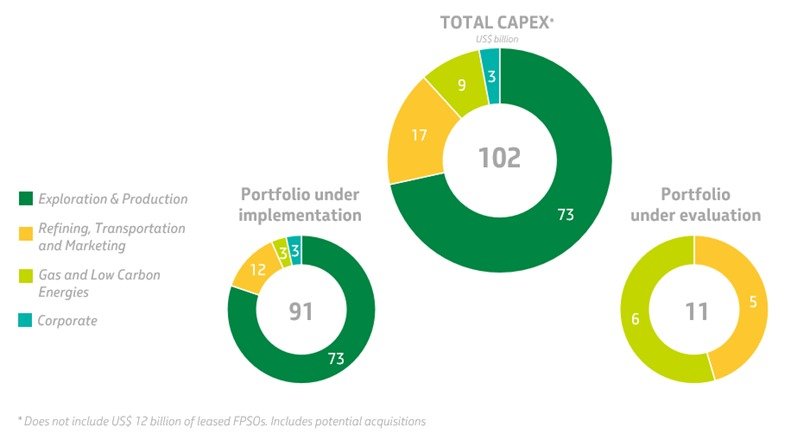

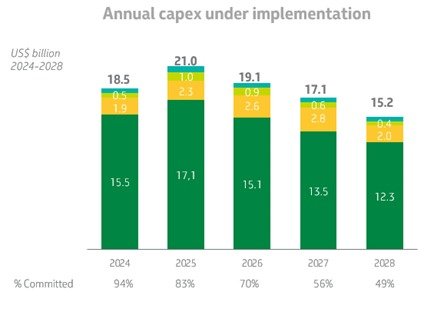

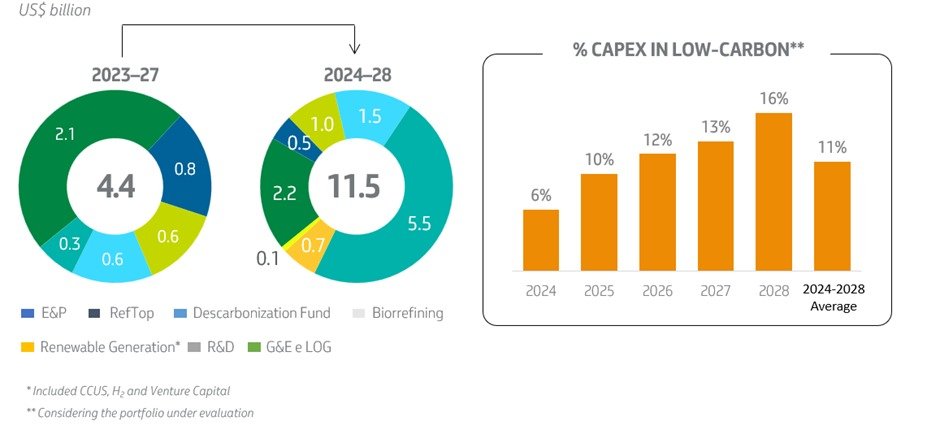

The investments (CAPEX) for 2024-2028 total US$ 102 billion, with US$ 91 billion for projects under implementation (portfolio under implementation) and US$ 11 billion for projects under evaluation (portfolio under evaluation). Both are subject to additional financeability studies before contracting and execution. Once the studies are completed with their economic viability certified, these projects can move to the Implementation Portfolio. The financeability study for projects under evaluation is an additional component integrated to the project approval governance, which will be used for both portfolios. This method of portfolio presentation underscores our commitment to transparency and advancement in project approval governance.

Increased CAPEX investments are primarily associated with new projects, including potential acquisitions, assets that were being disinvested and returned to the company's investment portfolio, as well as cost inflation, which had an impact on the entire supply chain.

The investments will be made primarily with Petrobras' own resources generated by its operations. The company's gross debt will remain limited to US$65 billion, a reasonable amount for companies in the segment and size of Petrobras.

CAPEX in the Exploration and Production (E&P) segment represents 72% of the total, followed by Refining, Transport and Marketing (RTC) with 16%, Gas and Energy (G&E) and Low Carbon with 9% and Corporate with 3%.

E&P projects with competitive costs, lower emissions and greater economic value

E&P CAPEX for 2024-2028 totals US$73 billion, with around 67% being allocated to pre-salt projects. Investments in this area have great economic and environmental competitive advantage with the production of high-quality oil and lower gas emissions greenhouse effect.

The E&P segment is still relevant for the company as it focuses on profitable assets and investments compatible with a long-term vision aligned with the energy transition. At the same time, the company maintains large deepwater revitalization projects (REVIT), and a number of other complementary projects to increase recovery factors in mature fields.

“Investments in exploration and production will still be necessary to meet energy demands. Hence, we seek to replenish reserves and develop new exploratory frontiers that contribute to fulfilling global energy needs while energy transition while minimizing the carbon footprint during the ongoing energy transition”, explains Jean Paul Prates. "Our operation, acknowledged for its excellence in technology, safety and low emissions, enables us to displace less efficient operations. It’s about doing our part so that this industry fully commits to the solution to the climate crisis”, the president added.

US$7.5 billion will be allocated to exploration projects over the five years, with US$3.1 billion for exploration in the Equatorial Margin; US$3.1 billion for exploration in the Southeast Basins; US$1.3 billion to other countries. This investment included the drilling of around 50 wells in areas where the company has exploration rights in acquired blocks.

The E&P segment is resilient both in economic and environmental terms. Additionally, it has high economic value, with a viable portfolio in scenarios of low oil prices in the long term, with Brent with a prospective average equilibrium of US$ 25 per barrel, and with a carbon intensity commitment of up to 15 KgCO2e per barrel of oil equivalent by 2030.

Oil production, LNG and natural gas

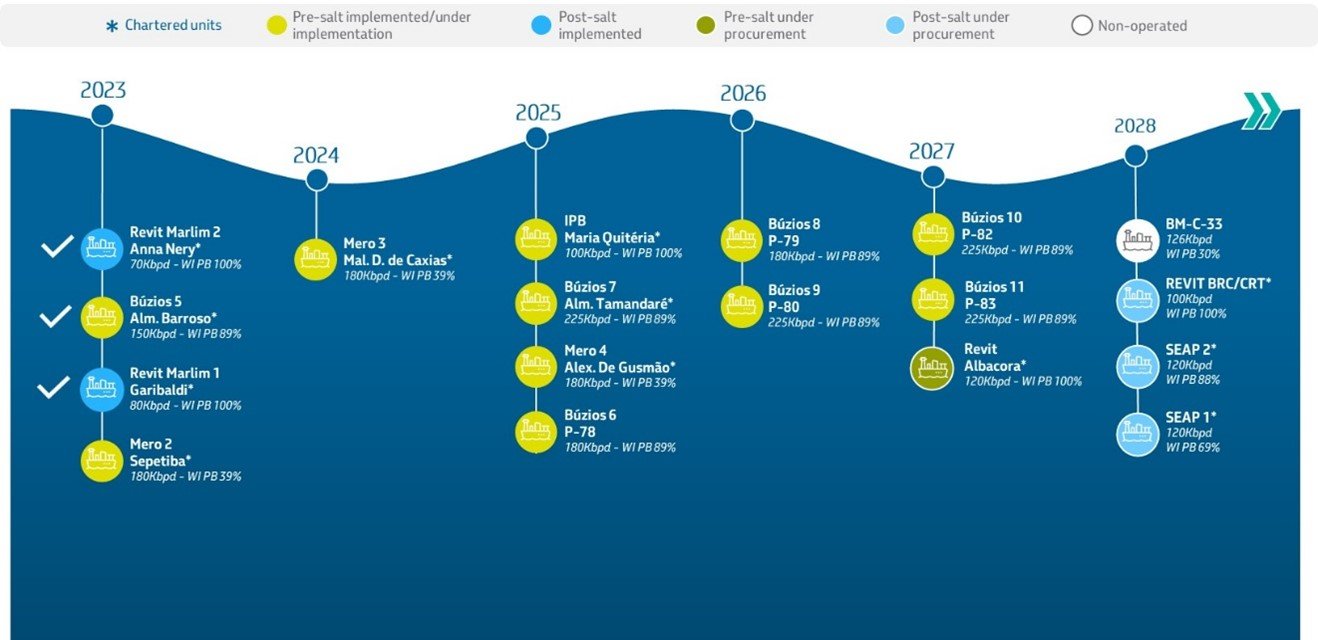

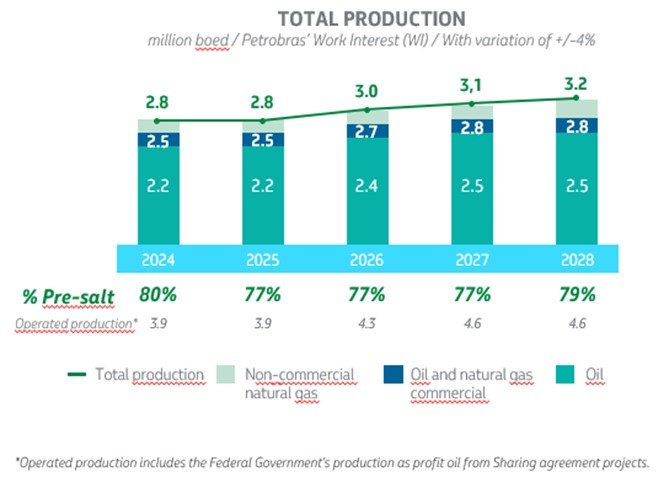

The production curve considers the entry of 14 new platforms (FPSOs) from 2024 to 2028, ten of which having already been contracted. A new generation of more modern, more technological, more efficient platforms, with lower emissions, is being built.

With this plan, Petrobras plans to produce the equivalent of 3.2 million barrels of oil and gas per day in five years.

Projections for oil production, total and commercial production of oil and natural gas for 2024 were increased by approximately 100,000 bpd/boed, compared to the previous plan, considering the good performance of the fields, forecasts for ramp-ups and new wells.

In 2025 and 2026, the projection of oil production, total and commercial production of oil and natural gas were lower than projected in the previous plan by around 100,000 bpd/boed. This difference is primarily due to current supply market scenario, whose schedules of some production systems and complementary deepwater projects have been altered. For 2027, projections for oil production and total and commercial production of oil and natural gas were the same as those in the previous plan. A variation margin of +-4% will be taken into account for plan monitoring.

Refining with greater production of diesel and low-carbon products

CAPEX in the Refining, Transport and Commercialization (RTC) area totals US$ 17 billion for the period 2024-2028. The segment continues to focus on better use of refining and logistics assets and greater energy efficiency, with an eye to expanding diesel production capacity and gradually increasing the supply of products for the low-carbon market. It is worth noting that, for PE 2024-28+, the CAPEX forecast for Marketing and Logistics, as disclosed in the previous plan, is now presented as CAPEX for Refining, Transport and Marketing (RTC), which aligns with the vision of this segment.

PE 2024-28+ foresees an increase in processing capacity in refineries by 225,000 barrels per day (bpd) and S-10 diesel production by over 290,000 bpd by 2029. This increase is supported by large projects such as Trem 2 at RNEST, revamps of current units and implementation of new diesel production units (HDT) at REVAP, REGAP, REPLAN, RNEST and GASLUB.

One notable feature of the new plan is the expansion of the Reftop Program to the entire refining park. Reftop plays a crucial role for Petrobras as the company to attain efficiency and reliability goals. Notably, it has already yielded savings of approximately US$589 million from 2021 to 2023 with actions in refineries in the Southeast of Brazil. With Reftop, Petrobras aspires to have one of the world’s best industrial parks in operational and energy efficiency by 2030.

In biorefining, US$ 1.5 billion will be invested. These investments will provide the necessary support for the increased Diesel R5 production capacity, with 5% renewable content, at REPAR, RPBC, REDUC and REPLAN. According to the plan, a number of resources will be used for the installation of dedicated aviation biokerosene and 100% renewable diesel plants in RPBC and GASLUB, which will be completed after 2028.

The Plan makes Petrobras stronger in the Brazilian market, integrating the value chain from production, refining, logistics to the market. US$2.1 billion will be invested in initiatives to remove logistical bottlenecks, with expanded and adapted infrastructure, investments in terminals for optimization of operations, expansion of modals and increased efficiency and resilience. The projects include the construction of four handy class ships, to be operated by Transpetro, as well as studies for other vessels.

In the Petrochemical segment, Petrobras plans to maximize synergies with its oil and gas refining and production park, promoting integration. Investments in petrochemicals, encompassing both current assets and acquisitions, are on the horizon.

In this PE 2024-28+, Petrobras is also re-entering the fertilizers segment, with intentions to restart ANSA operation and complete the construction of UFN 3.

Expansion of gas offer capacity

CAPEX in the Gas & Energy area totals US$ 3 billion in the five-year period. The segment advances in competitive and integrated operations in the gas and energy trade and in portfolio enhancement, as it tried to incorporate renewable sources, in line with decarbonization actions.

One of Petrobras' priorities in this segment is expanding its infrastructure and portfolio of natural gas offerings. As for investments in gas production and flow in the E&P segment, the company plans to increase Petrobras' national gas supply by investing around US$7 billion over the next five years.

In 2024, Rota 3 will come into operation with a processing plant with a capacity of 21 MMm³/day and a gas pipeline with a capacity of 18 MMm³/day. In 2028, the Projeto Raia gas pipeline (BM-C-33) will begin its operation, with a capacity of 16 Mmm³/day. On the other hand, in 2029, the Sergipe Águas Profundas – SEAP project gas pipeline will come into operation, with a capacity of 18 MMm³/day.

Double investments in low carbon

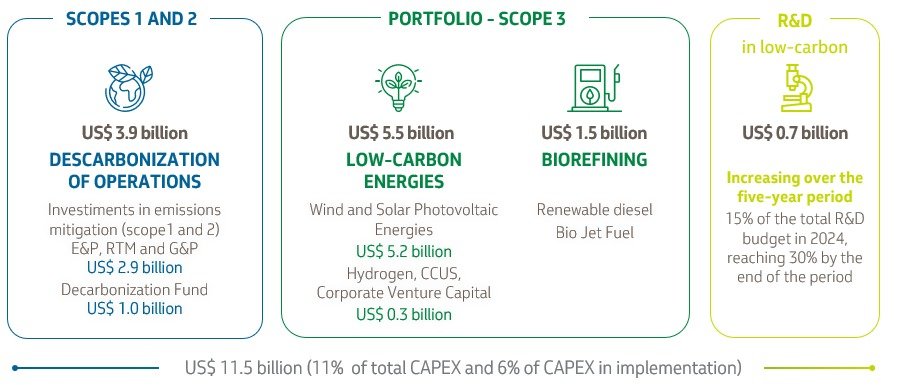

Petrobras will allocate US$11.5 billion to low-carbon projects over the next five years, more than twice as much when compared to the previous plan. Initiatives and projects to decarbonize operations are included, as well as the development and maturation of businesses in the low-carbon energy segment, with emphasis on biorefining, wind energy, solar energy, carbon capture, utilization and storage (CCUS) and hydrogen.

“Petrobras is investing in new energy projects again. We will choose profitable projects, and give priority to partnerships to reduce risk and share learning. With this new front, we also want to develop Brazil’s regional competitive advantages”.

On average, for the period 2024-2028, investments in low carbon account for 11% of Petrobras' total investment. This indicates that the company is outpacing some of its market peers. Investments in low carbon are expected to gradually gain momentum in the company's portfolio over the period, reaching 16% by 2028.

Environmental, Social and Governance Commitments (ESG)

In PE 2024-28+, some of Petrobras’ priorities are to reduce its carbon footprint, protect the environment, take care of people, and act with integrity. Petrobras reaffirms its ambition to have zero fatalities and zero leaks, which aligns with its commitment to life and the environment, as these are non-negotiable values. ESG focuses on the following commitments:

Reduce of carbon footprint

- Neutralization of emissions (scopes 1 and 2) in activities under Petrobras' control by 2050 and encourage its partners to do the same in non-operated assets1

- Reduction of total operational absolute emissions by 30%2 by 2030 (54.8 MM ton/year)

- Zero routine flaring by 2030

- Reinjection of 80 million tCO2 by 2025 in CCUS projects

- GHG intensity in the E&P segment: Reach portfolio intensity of 15 kgCO2e/boe by 2025, maintained at 15 kgCO2e/boe by 2030

- GHG intensity in the Refining segment: Reach intensity of 36 kgCO2e/CWT by 2025 and 30 kgCO2e/CWT by 2030

- Reduce the intensity of methane emissions in the upstream segment by 2025, reaching 0.25 t CH4/thousand THC and reaching 0.20 t CH4/thousand THC in 2030

Protect the environment

- Zero leak ambition

- 40%3 reduction in our freshwater abstraction by 2030 (91 MM m3/year)

- 30%3 reduction in the generation of solid process waste by 2030 (195,000 tons/year)

- Destination of 80% of solid waste from processes to Reuse, Recycling and Recovery (RRR)4 routes by 2030

- Achieve biodiversity gains by 2030, with a focus on forests and oceans

- 100% of Petrobras installations with biodiversity action plans by 2025

- Net positive impact on vegetated areas by 2030

- 30% increase in biodiversity conservation efforts

Take care of people

- Zero fatality ambition

- Return at least 150% of the amount invested in voluntary socio-environmental projects5 to society (by 2030)

- Be among the top 3 O&G companies in the Human Rights ranking by 20306

- Diversity:

• Women in leadership roles: 25% by 2030

• People of various colors and races in leadership roles: 25% by 2030

- Implement 100% of the actions of the Mente em Foco Movement (UN Global Compact) by 2030

- Reach more than 50% of physically active employees (EFA) contributing to a healthier and more productive life by 2028

Act with integrity

- Promote diversity in Petrobras' nominations for our participations:

• Have 30% of women in the Board of Directors (CA), Executive Board (DE) and Fiscal Council (CF) by 2026

• Increase the number of African-Brazilian individuals to CA, DE and CF by 10% by 2030

- Conclude sexual violence investigations within 60 days by 2024

- Provide Integrity and/or Privacy training to 100% of relevant suppliers by 2030

- Perform Human Rights Due Diligence on 100% of our relevant suppliers by 2030

- Assess the expansion of ESG requirements in 100% new strategic position hires

- Establish that 70% of relevant suppliers have their emissions inventory (GHG) published

In PE 2024-28+, the company's values were revised and are now: (i) Care for people; (ii) Integrity; (iii) Sustainability; (iv) Innovation; and (v) Commitment to Petrobras and the country.

The top metrics have also been adjusted and now include the Serious Injury Rate (TAG) metric, which is recorded together with the Recordable Injury Rate (TAR) metric in the Commitment to People Safety Indicator (ICSP). The following top metrics have been included:

- Indicator of compliance with greenhouse gas emissions targets (IAGEE) for Exploration and Production and Refining;

- Indicator of commitment to the environment (ICMA), represented by the indicator of leaked volume of oil and oil products (VAZO);

- Financial indicator Delta Valor (Dvalor); and

- Indicator of commitment to people's safety (ICSP), represented by the TAG and TAR indicators.

The first 3 metrics (IAGEE, ICMA and Dvalor) have a direct impact on the remuneration of the company’s executives and all staff members. They can be used as a means of ensuring the achievement of corporate goals.

Finally, Petrobras reaffirms its vision and strategic elements released in June 2023: Petrobras approves drivers of 2024-28 Strategic Plan | Petrobras Agency.

1 Ambitions for emissions in Brazil, where more than 97% of the company's operational emissions occur. For other emissions, we also aim to achieve neutrality within the terms of the Paris Agreement, in line with local commitments and international organizations.

2 Reference year: 2015

3 Reference year: 2021 |

4Reuse, Recycling and Recovery

5 Per project, being subject to measurement (3 years)

6 In Corporate Human Rights Benchmark (CHRB)

Photos

Photos

Use of this material is authorized for editorial purposes only.